-

Professional Guide to Ind AS | 4th Edition 2024 | Commercial Law Publishers (India) Pvt. Ltd

Regular price Rs. 1,849.00Regular priceUnit price perRs. 2,299.00Sale price Rs. 1,849.00Sale -

Professional Guide to TAX AUDIT (Financial Years 2024-2025 and 2025-2026) | 8th Edition 2025 - Commercial Law Publishers

Regular price Rs. 1,249.00Regular priceUnit price perRs. 1,791.00Sale price Rs. 1,249.00Sale -

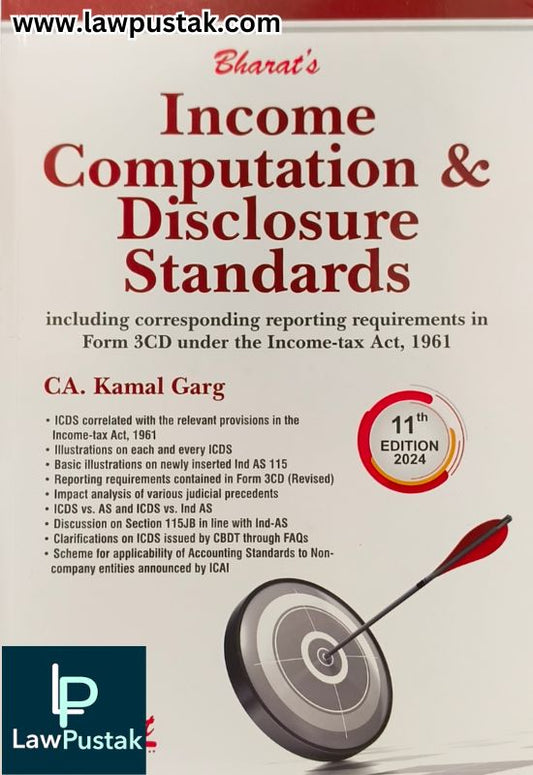

Income Computation & Disclosure Standards By CA. Kamal Garg - 11th Edition 2024 - Bharat Law House

Regular price Rs. 1,121.00Regular priceUnit price perRs. 1,495.00Sale price Rs. 1,121.00Sale -

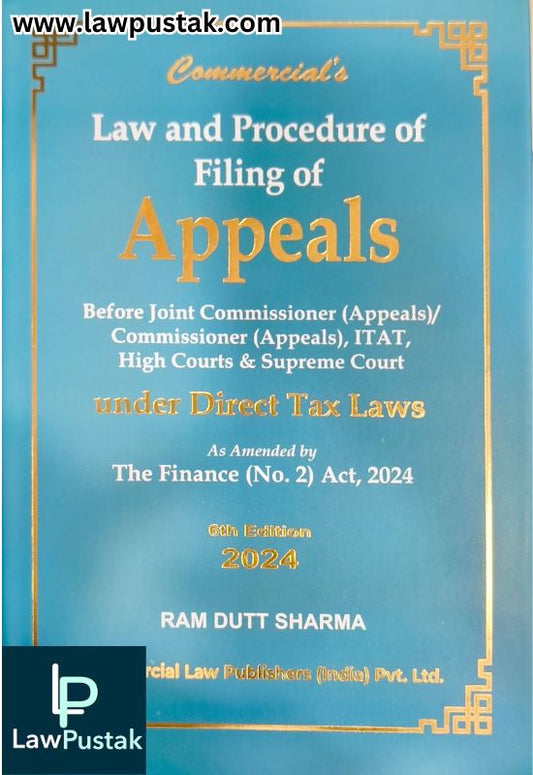

Law and Proecedure of Filing of Appeals under Direct Tax Laws by Ram Dutt Sharma - 6th Edition 2024 - Commercial Law Publishers

Regular price Rs. 1,496.00Regular priceUnit price perRs. 1,995.00Sale price Rs. 1,496.00Sale -

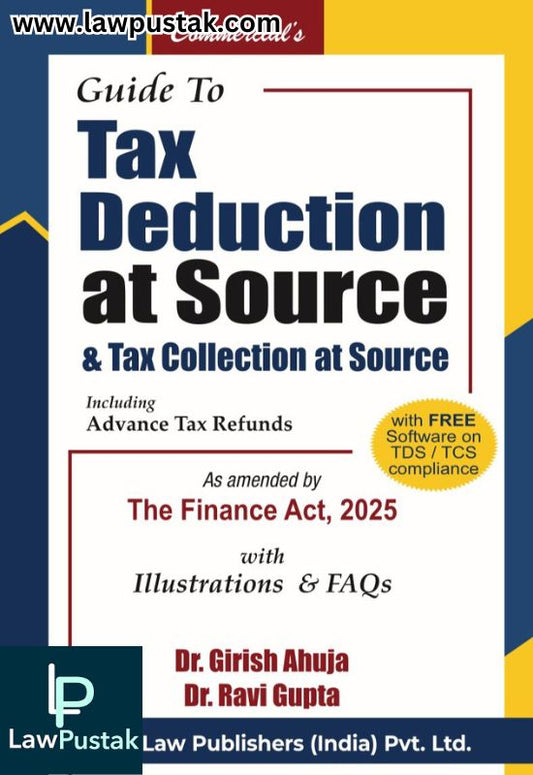

Guide to Tax Deduction at Source & Tax Collection at Source Including Advanced Tax Refunds By Dr. Girish Ahuja & Dr. Ravi Gupta - 22nd Edition 2025 - Commercial Law Publishers

Regular price Rs. 2,096.50Regular priceUnit price perRs. 2,995.00Sale price Rs. 2,096.50Sale -

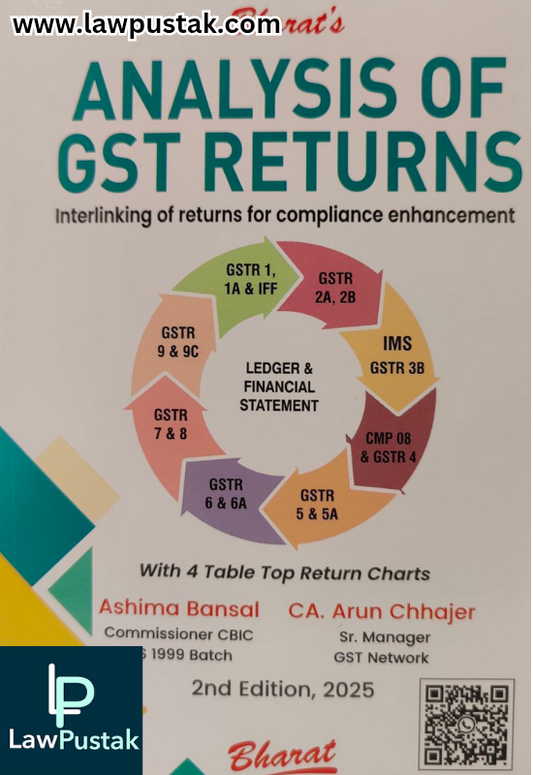

Analysis Of GST Returns (Interlinking of returns of compliance enhancement) by Ashima Bansal & CA. Arun Chhajer | 2nd Edition 2025 | Bharat Law House

Regular price Rs. 839.00Regular priceUnit price perRs. 1,195.00Sale price Rs. 839.00Sale -

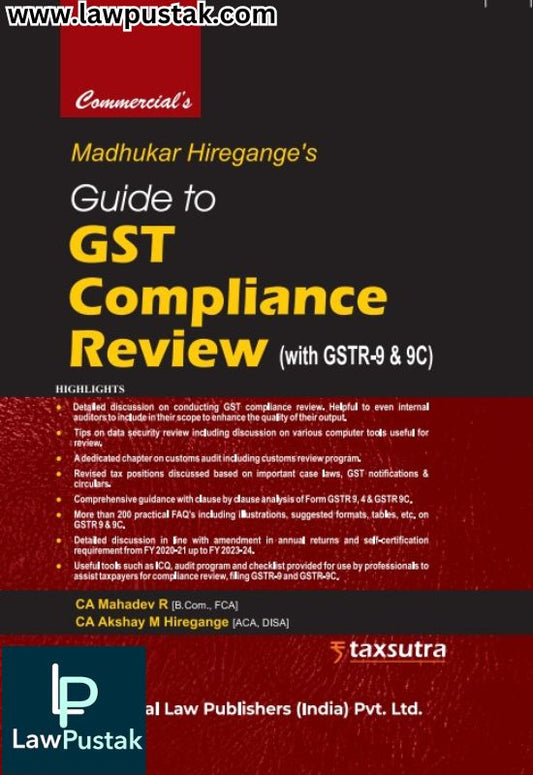

Guide To GST Compliance Review ( with GSTR-9 & 9C) By Madhukar Narayan Hiregange - Edition 2024 - Commercial Law Publisher

Regular price Rs. 1,871.00Regular priceUnit price perRs. 2,495.00Sale price Rs. 1,871.00Sale -

Supreme Court Judgements on GST By Dr. Sanjiv Agarwal & CA (Dr.) Neha Somani - 3rd Edition 2025 - Commercial Law Publishers (india) Pvt. Ltd.

Regular price Rs. 2,209.00Regular priceUnit price perRs. 3,295.00Sale price Rs. 2,209.00Sale -

Handbook To DIRECT TAXES by Bomi F. Daruwala-34rd Edition 2025- Bharat Law House

Regular price Rs. 1,679.00Regular priceUnit price perRs. 2,395.00Sale price Rs. 1,679.00Sale -

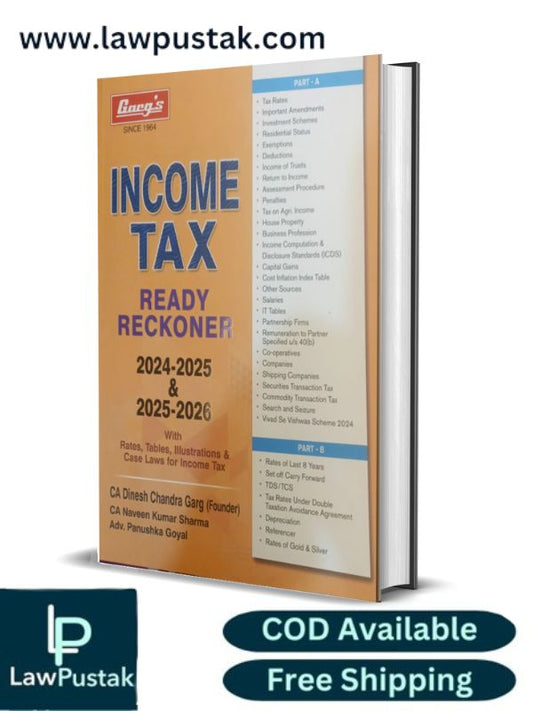

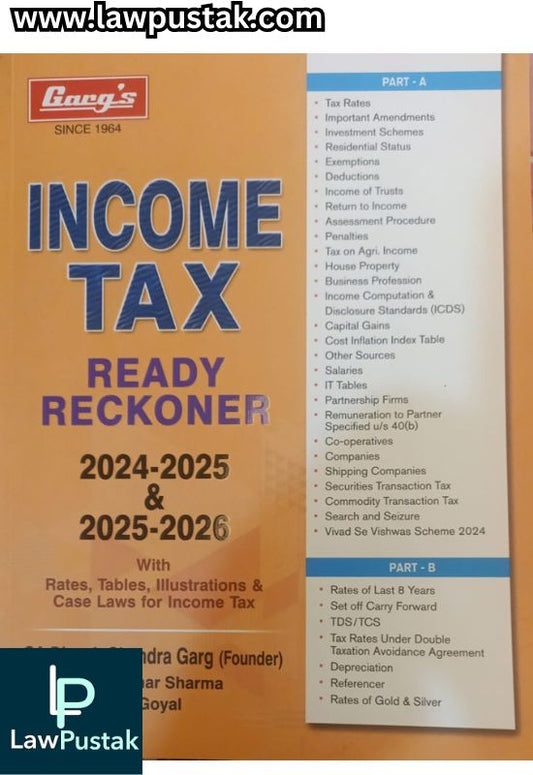

Garg's Income Tax ready Reckone 2024-2025 & 2025-2026 With Rates, Tables, Illustrations & Case Laws for Income Tax

Regular price Rs. 1,662.00Regular priceUnit price perRs. 2,375.00Sale price Rs. 1,662.00Sale -

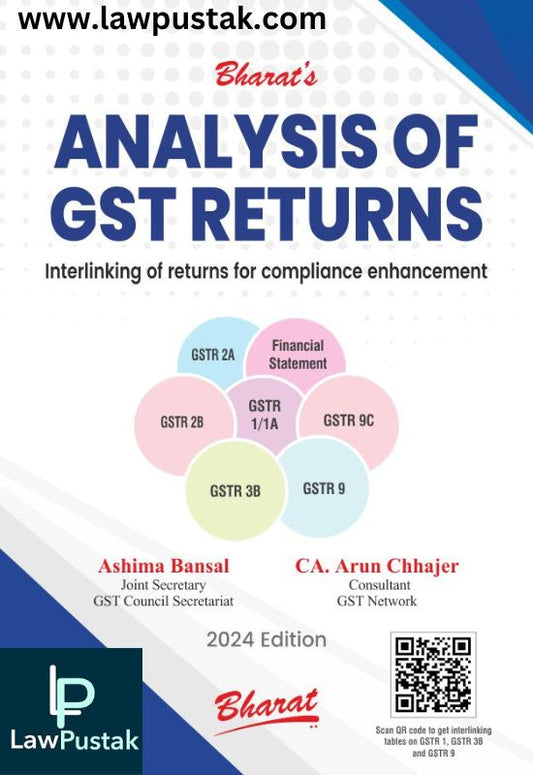

Analysis Of G S T Returns By Ashima Bansal Ca. Arun Chhajer-1st Edition 2024-Bharat Law House

Regular price Rs. 545.00Regular priceUnit price perRs. 595.00Sale price Rs. 545.00Sale -

Reporting under FORM 3CD – A READY RECKONER by CA. KAMAL GARG-2nd Edition 2024-Bharat Law House

Regular price Rs. 696.00Regular priceUnit price perRs. 995.00Sale price Rs. 696.00Sale -

Comprehensive Guide to Reverse Charge under GST by Dhruv Dedhia-Edition 2024-Commercial Law Publishers

Regular price Rs. 695.00Regular priceUnit price perRs. 995.00Sale price Rs. 695.00Sale -

Double Taxation Treaties Concepts, Practices and Trends By K R Sekar-1st Edition-OakBridge

Regular price Rs. 2,892.00Regular priceUnit price perRs. 4,450.00Sale price Rs. 2,892.00Sale -

Methods of Investigations of Books of Accounts and Other Documents By Ram Dutt Sharma-Edition 2024-Commercial's

Regular price Rs. 906.00Regular priceUnit price perRs. 1,295.00Sale price Rs. 906.00Sale -

Understanding the Special provisions of Presumptive Taxation Scheme By Ram Dutt Sharma-Edition 2024-Commercial's

Regular price Rs. 486.00Regular priceUnit price perRs. 695.00Sale price Rs. 486.00Sale