-

Exhaustive FAQ's On GST By CA jeevanand Kumar Jha, FCA Gagan Kumar Jha, Advocate Amit Kumar Jha & FCA Jitendra Chaudhary - May 2025 Edition - Young Global Publications

Regular price Rs. 539.00Regular priceUnit price perRs. 895.00Sale price Rs. 539.00Sale -

Income Tax Assessment of Trade Specific Sectors Under the Provisons of Income Tax law By Ram Dutt Sharma - 1st Edition 2025 - Commercial Law Publisher

Regular price Rs. 1,889.00Regular priceUnit price perRs. 2,695.00Sale price Rs. 1,889.00Sale -

Let Us Know Taxes In India 2025-26, 2026-27 By Arun Kumar Chandak, Vinay Malani and Akshat Chandak - 21th Edition, April 2025 - A Puri Publication

Regular price Rs. 559.00Regular priceUnit price perRs. 790.00Sale price Rs. 559.00Sale -

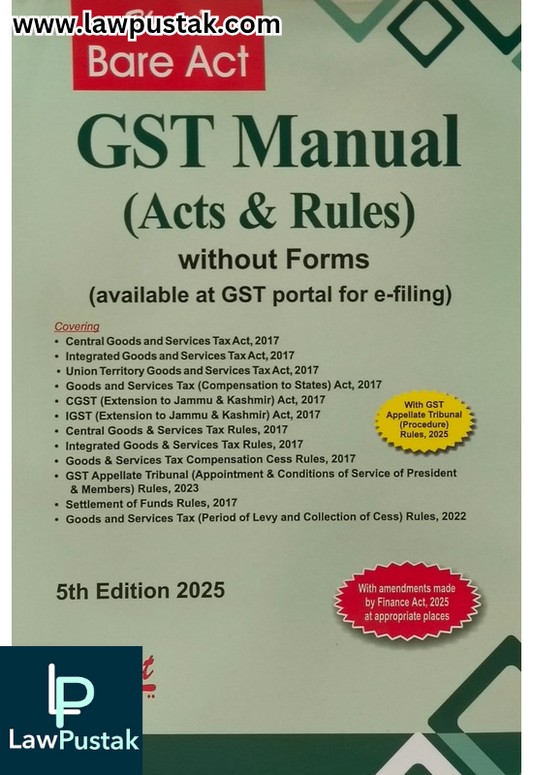

GST Manual (Act & Rules) without Forms - 5th Edition 2025 BareAct - Bharat Law House

Regular price Rs. 579.00Regular priceUnit price perRs. 895.00Sale price Rs. 579.00Sale -

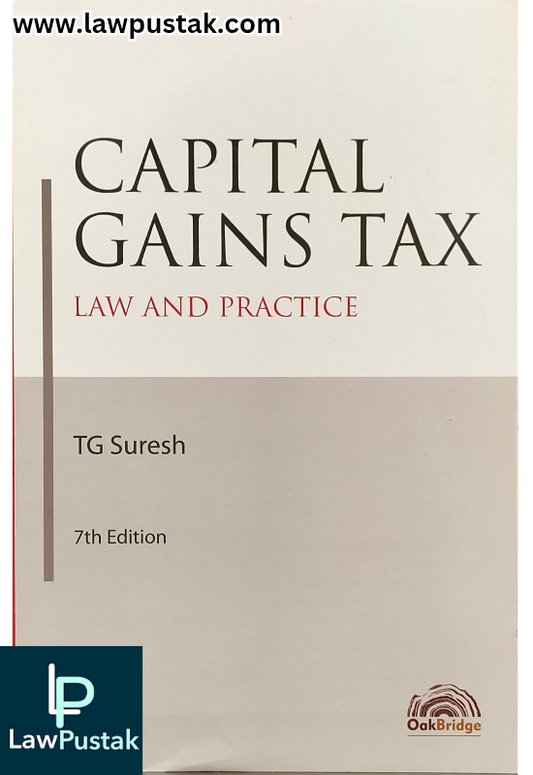

Capital Gains Tax Law and Practice By TG Suresh - 7th Edition 2024 - Oakbridge Publishing

Regular price Rs. 699.00Regular priceUnit price perRs. 995.00Sale price Rs. 699.00Sale -

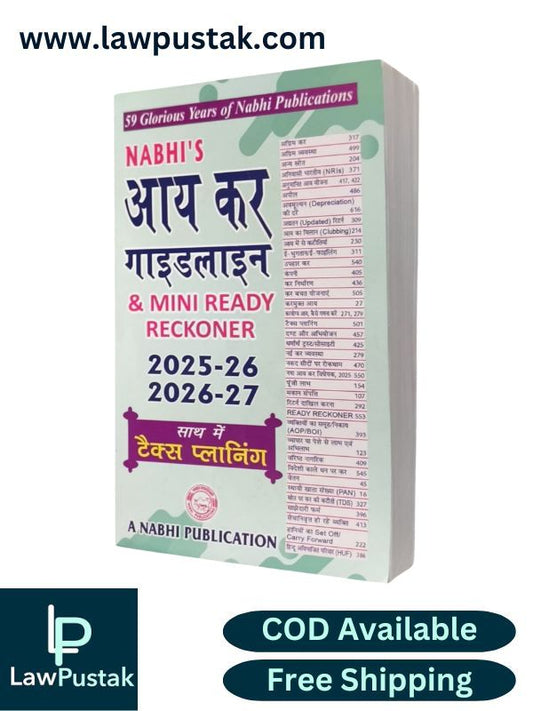

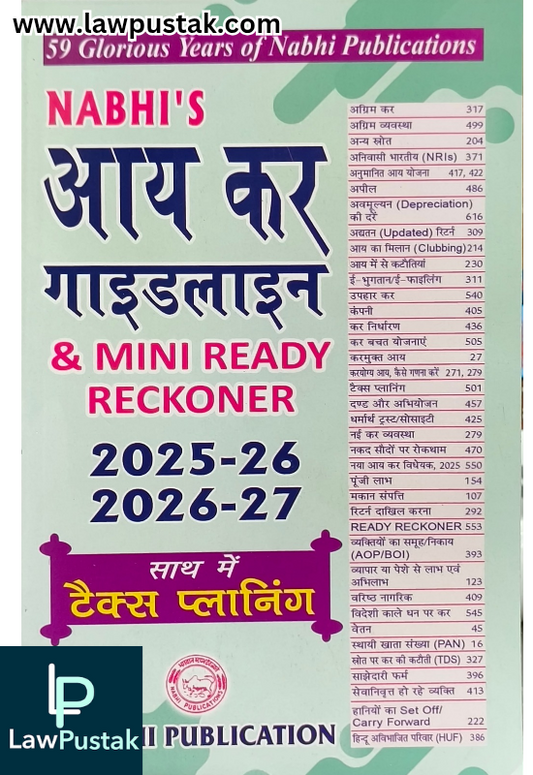

Income Tax Guidelines and Mini Ready Reckoner 2025-26 and 2026-27 Alongwith Tax Planning in Hindi - 22st Edition 2025 - A Nabhi Publication

Regular price Rs. 799.00Regular priceUnit price perRs. 990.00Sale price Rs. 799.00Sale -

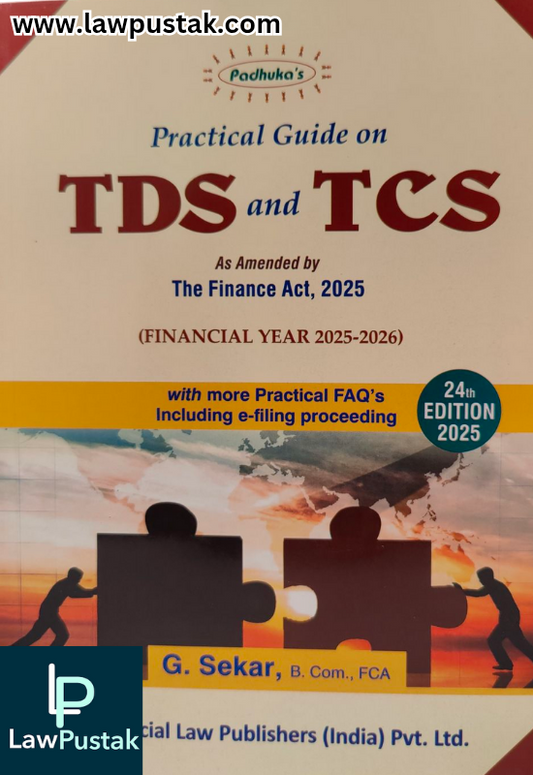

Practical Guide on TDS and TCS As amended by The Finance (No.2) Act, 2025 By G. Sekar - 24th Edition 2025 - Commercial Law Publishers

Regular price Rs. 969.00Regular priceUnit price perRs. 1,499.00Sale price Rs. 969.00Sale -

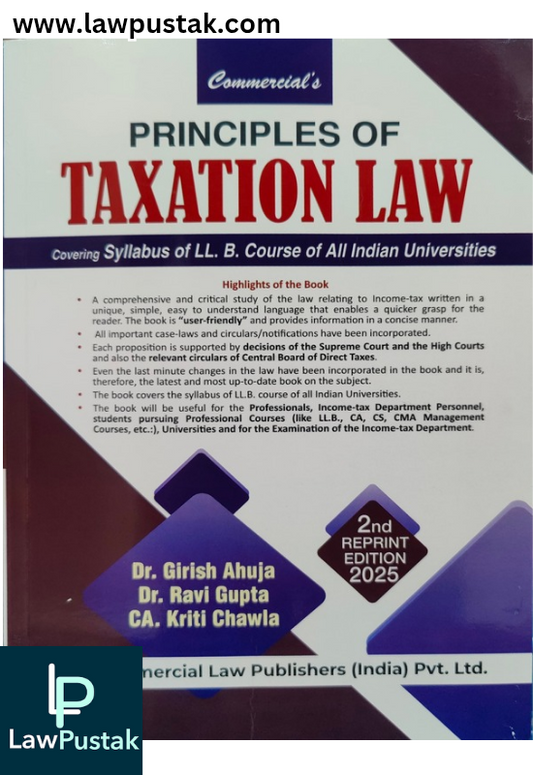

Principles of Taxation Law By Dr. Girish Ahuja, Dr. Ravi Gupta & Kriti Chawla - 2nd Edition 2025 - Commercial Law Publishers

Regular price Rs. 559.00Regular priceUnit price perRs. 795.00Sale price Rs. 559.00Sale -

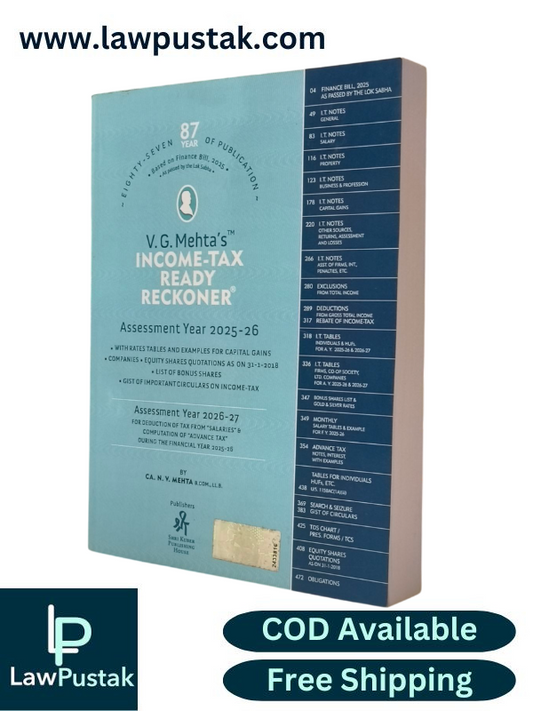

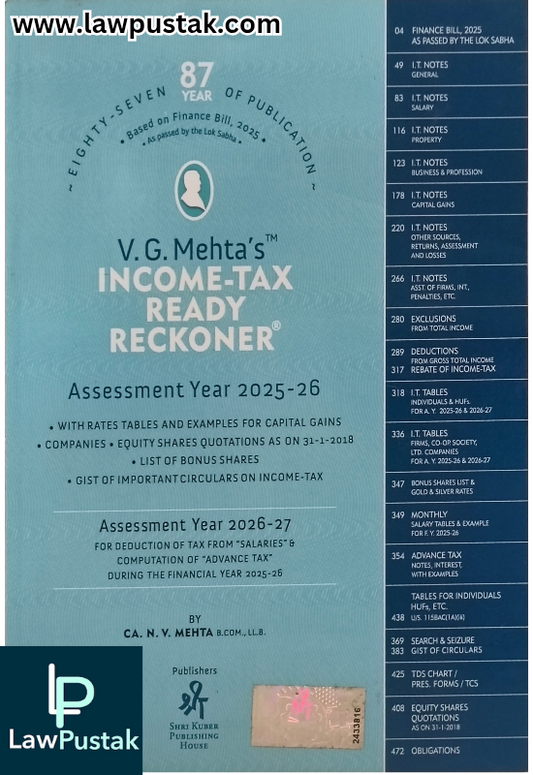

Income-Tax ready Reckoner Assessment Year 2025-26 By V.G. Mehta - Shri Kuber Publishing House

Regular price Rs. 1,439.00Regular priceUnit price perRs. 1,800.00Sale price Rs. 1,439.00Sale -

Insight into GST Litigations - A Practical Approach By Adv. B.S. Indani - 1st Edition 2025 - Bharat Law House

Regular price Rs. 799.00Regular priceUnit price perRs. 1,195.00Sale price Rs. 799.00Sale -

Tax Planning - Practical Aspects As amended by the Finance Act, 2025 By CA. Chunauti H. Dholakia - 2nd Edition 2025 - Bharat Law House

Regular price Rs. 909.00Regular priceUnit price perRs. 1,295.00Sale price Rs. 909.00Sale -

GST Law Simplified with forms, tariff, exemption & circulars By P.K. Goel - 2nd Edition 2024 - Bharat Law House

Regular price Rs. 949.00Regular priceUnit price perRs. 1,395.00Sale price Rs. 949.00Sale -

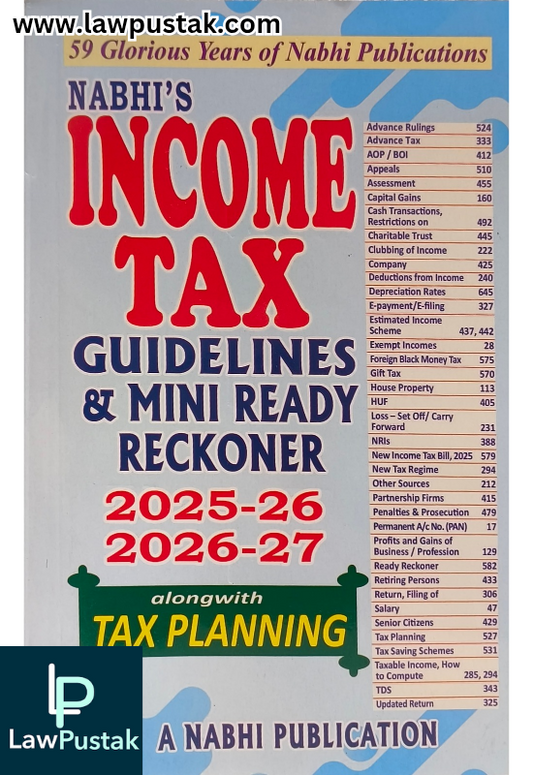

Income Tax Guidelines & Mini Ready Reckoner 2025-26 2026-27 alongwith Tax Plannig - A Nabhi Publication

Regular price Rs. 789.00Regular priceUnit price perRs. 990.00Sale price Rs. 789.00Sale -

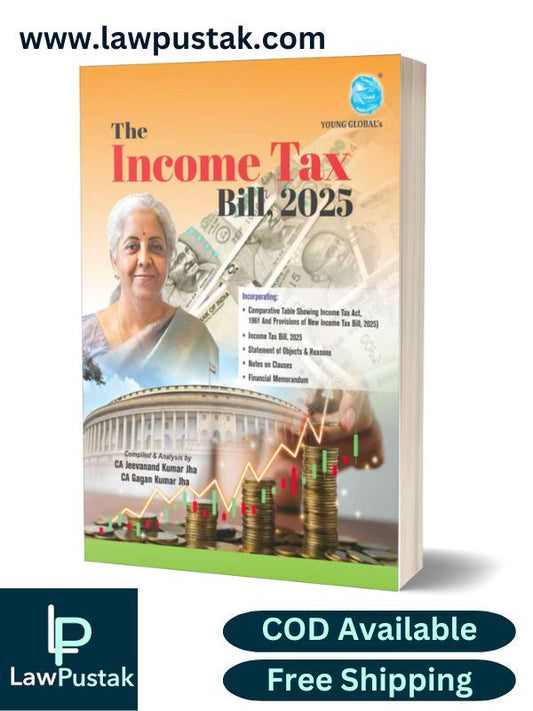

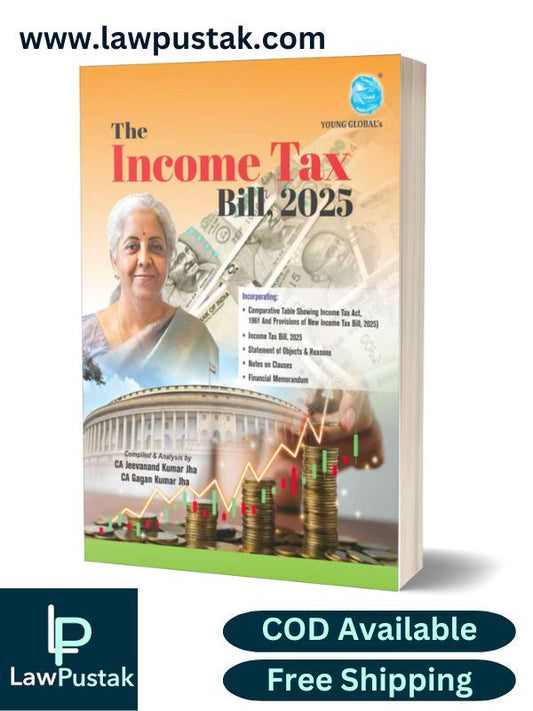

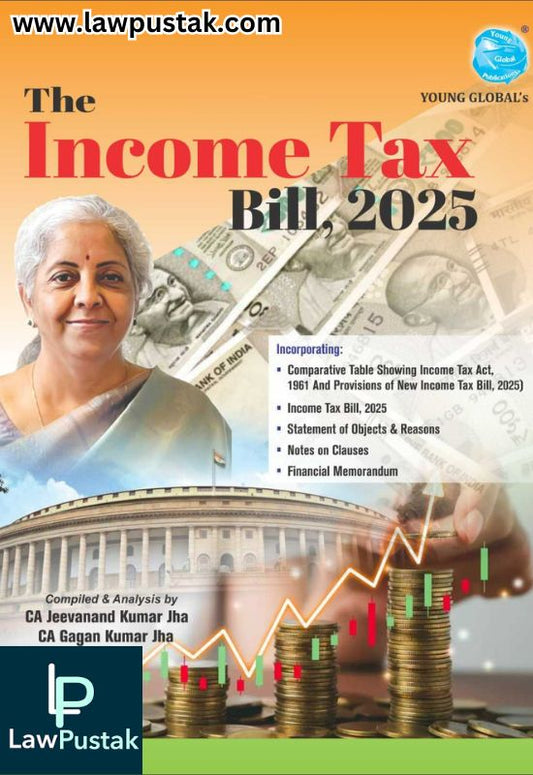

The Income Tax Bill, 2025 By CA Jeenvanand Kumar Jha & CA Gagan Kumar Jha - Young Global Publication

Regular price Rs. 899.00Regular priceUnit price perRs. 1,295.00Sale price Rs. 899.00Sale -

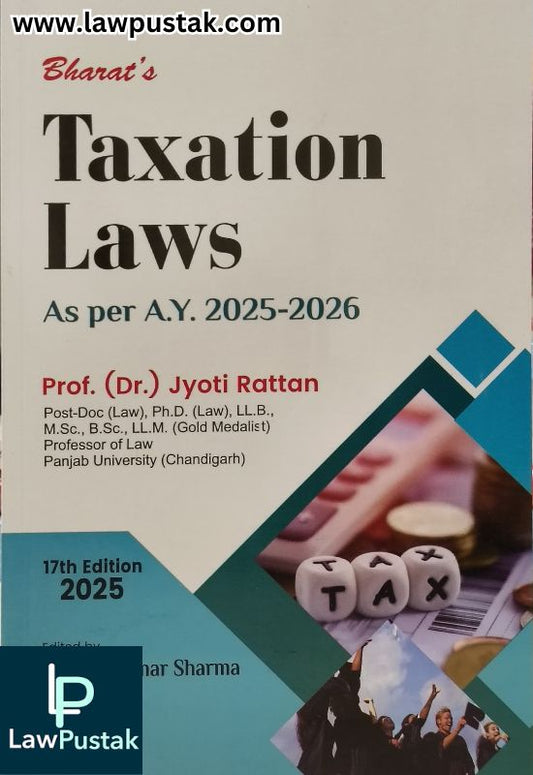

TAXATION LAWS by Dr. Jyoti Rattan – 17th Edition 2025 | Bharat Law House

Regular price Rs. 849.00Regular priceUnit price perRs. 1,050.00Sale price Rs. 849.00Sale -

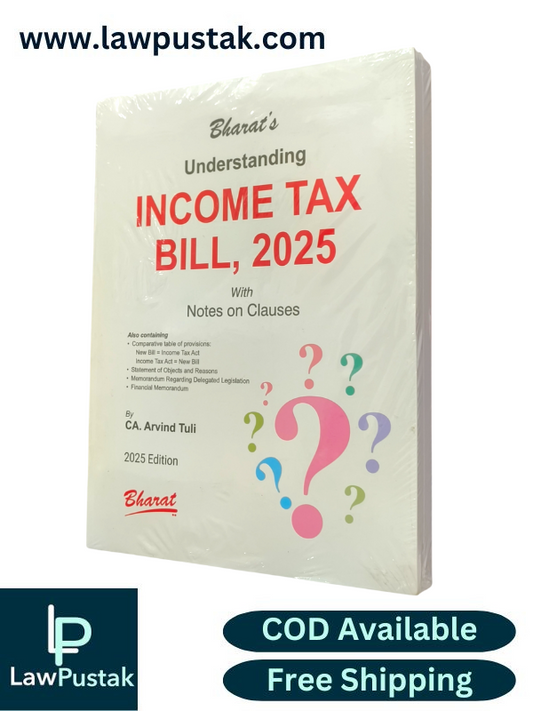

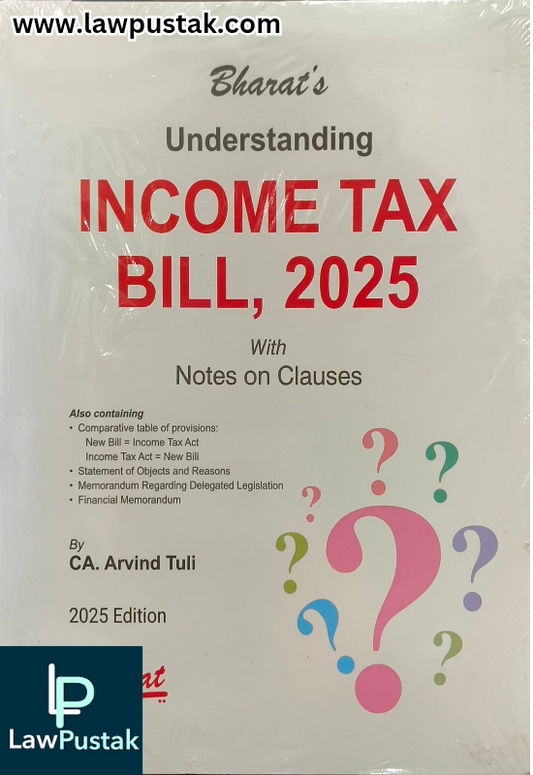

Understanding Income Tax Bill, 2025 with Notes on Clauses - Edition 2025 - Bharat Law House

Regular price Rs. 899.00Regular priceUnit price perRs. 1,295.00Sale price Rs. 899.00Sale