-

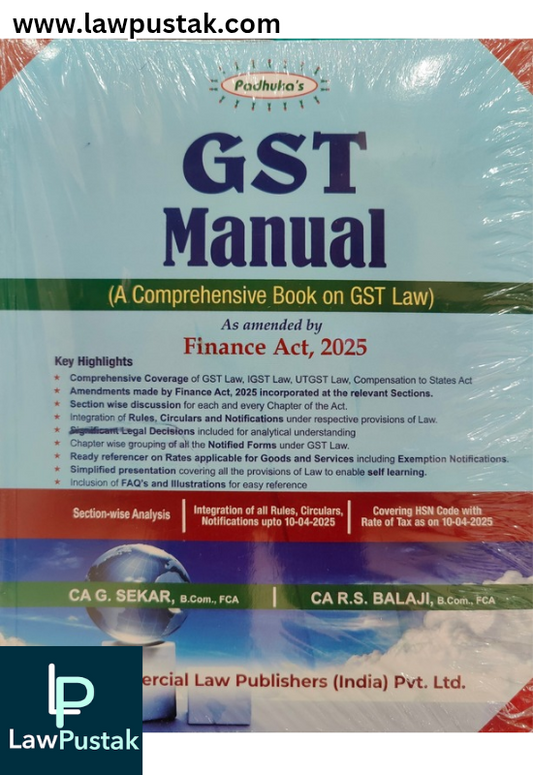

GST Manual (A Comprehensive Book on GST Law) As amended by Finance Act, 2025 By G. Sekar - 6th Edition 2025 - Commercial Law Publishers

Regular price Rs. 2,099.00Regular priceUnit price perRs. 2,997.00Sale price Rs. 2,099.00Sale -

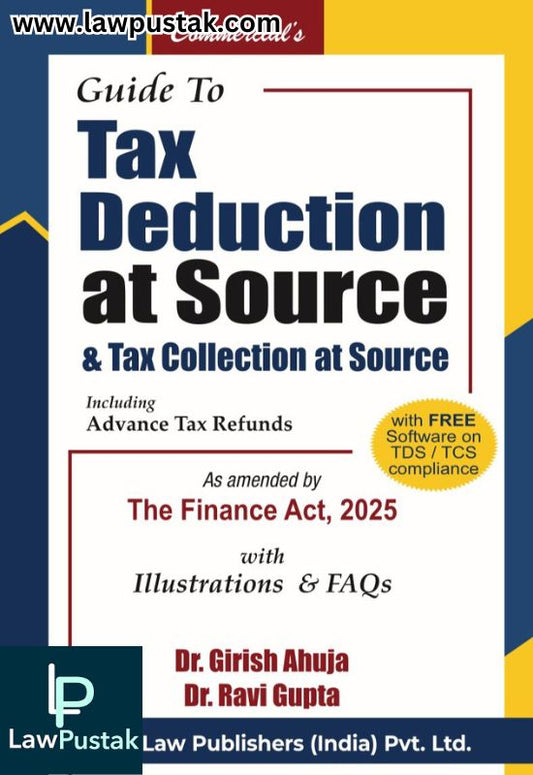

Guide to Tax Deduction at Source & Tax Collection at Source Including Advanced Tax Refunds By Dr. Girish Ahuja & Dr. Ravi Gupta - 22nd Edition 2025 - Commercial Law Publishers

Regular price Rs. 2,096.50Regular priceUnit price perRs. 2,995.00Sale price Rs. 2,096.50Sale -

Taxation of Capital Gains as amended by the Finance Act, 2025 By Dr. Girish Ahuja & Dr. Ravi Gupta - Commercial Law Publishers

Regular price Rs. 1,599.00Regular priceUnit price perRs. 2,295.00Sale price Rs. 1,599.00Sale -

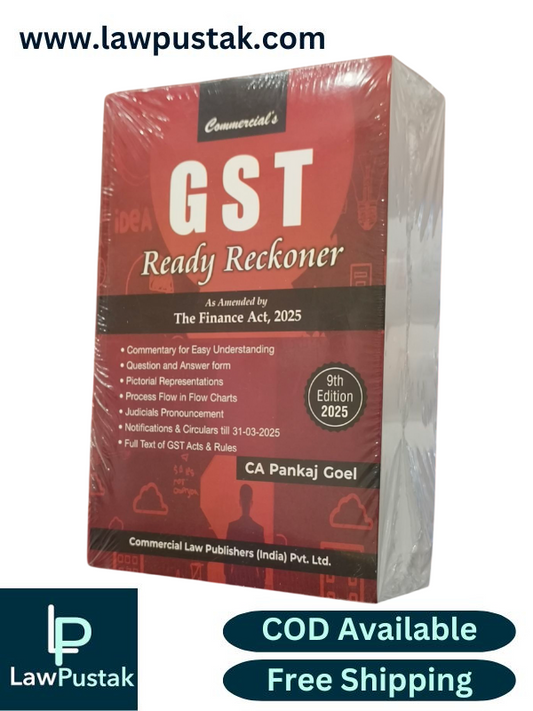

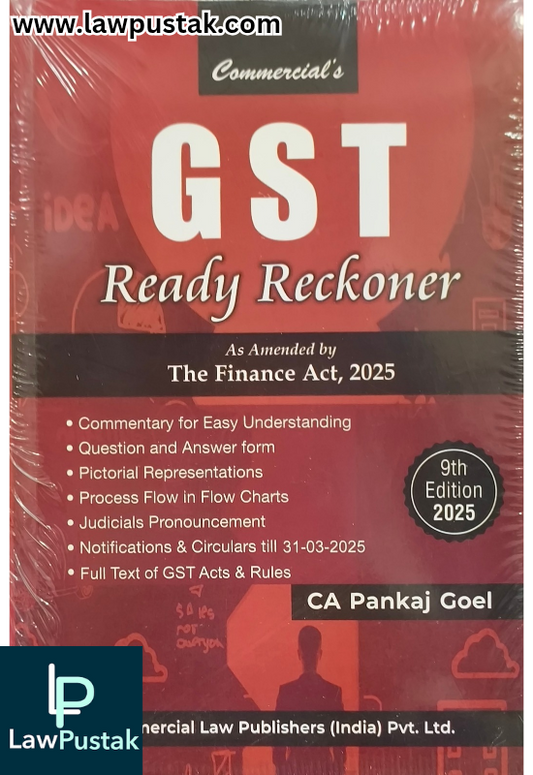

GST Ready Reckoner as Amended by The Finance Act, 2025 By CA Pankaj Goel - 9th Edition 2025 - Commercial Law Publisher

Regular price Rs. 2,099.00Regular priceUnit price perRs. 2,995.00Sale price Rs. 2,099.00Sale -

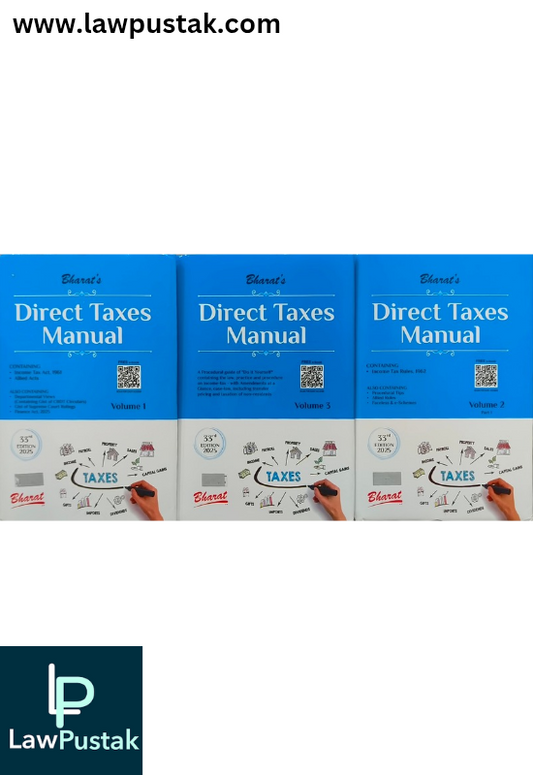

Direct Taxes Manual - 33rd Edition 2025 (In 3Volumes) - Bharat Law House

Regular price Rs. 4,939.00Regular priceUnit price perRs. 7,895.00Sale price Rs. 4,939.00Sale -

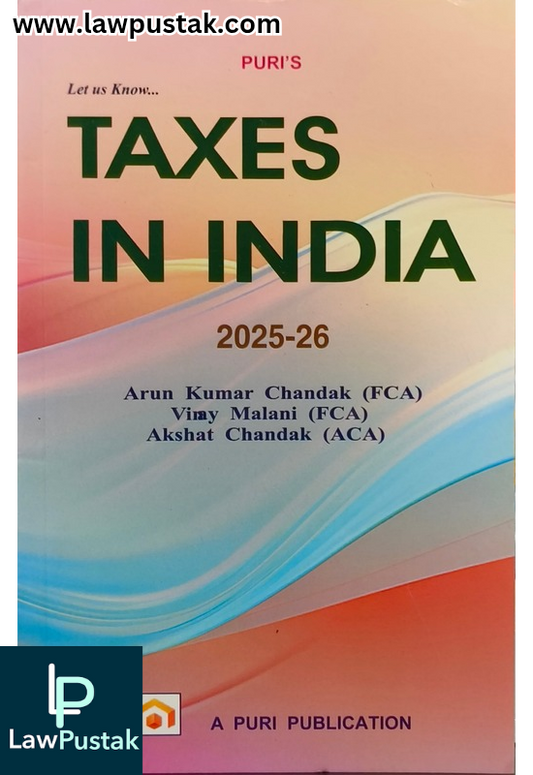

Let Us Know Taxes In India 2025-26, 2026-27 By Arun Kumar Chandak, Vinay Malani and Akshat Chandak - 21th Edition, April 2025 - A Puri Publication

Regular price Rs. 559.00Regular priceUnit price perRs. 790.00Sale price Rs. 559.00Sale -

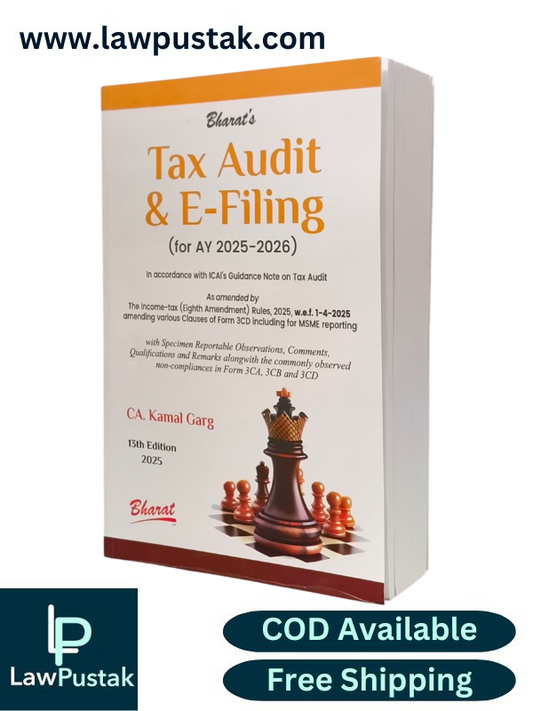

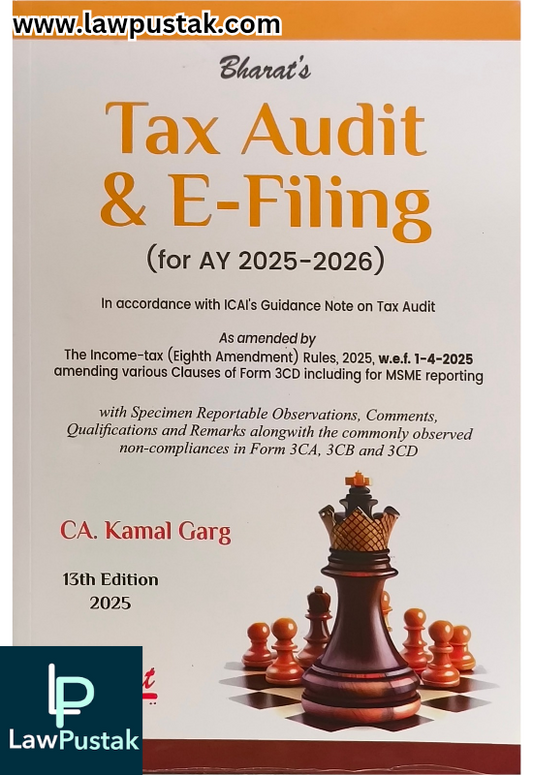

TAX AUDIT and E-FILING (for AY 2025-2026) by CA. Kamal Garg-13th Edition 2025-Bharat Law House

Regular price Rs. 1,749.00Regular priceUnit price perRs. 2,495.00Sale price Rs. 1,749.00Sale -

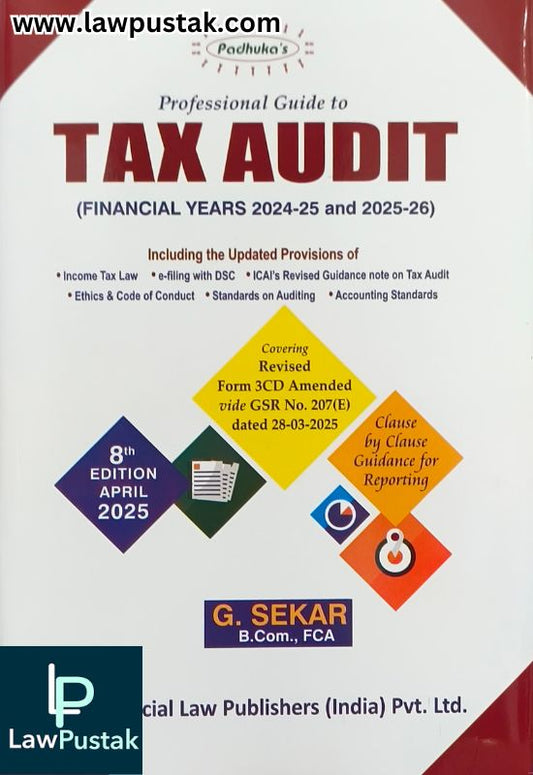

Professional Guide to TAX AUDIT (Financial Years 2024-2025 and 2025-2026) | 8th Edition 2025 - Commercial Law Publishers

Regular price Rs. 1,249.00Regular priceUnit price perRs. 1,791.00Sale price Rs. 1,249.00Sale -

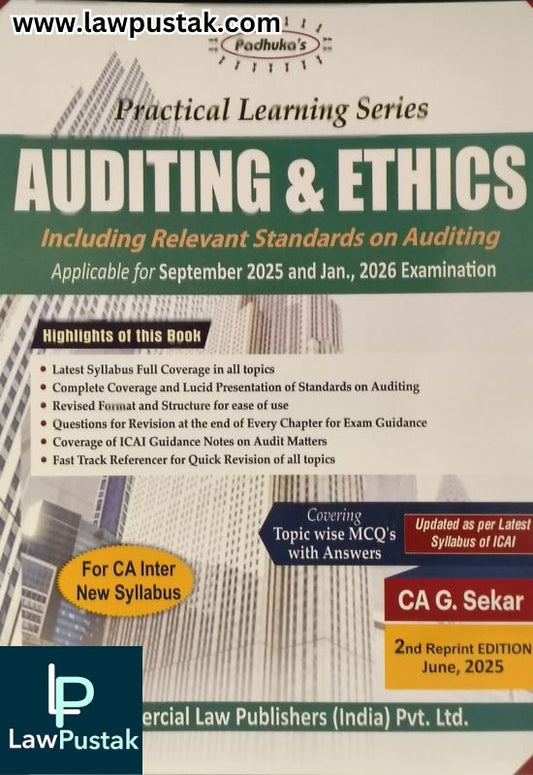

Practical Learning Series Auditing And Ethics by CA G Sekar | CA Inter | Applicable for September 2025 and Jan., 2026 Examination - 2nd Reprint Edition June 2025 | Commercial Law Publishers

Regular price Rs. 839.00Regular priceUnit price perRs. 1,289.00Sale price Rs. 839.00Sale -

All About Trusts & NGOs by CA. Chunauti H. Dholakia - 4th Edition 2025 -Bharat Law House

Regular price Rs. 1,329.00Regular priceUnit price perRs. 1,895.00Sale price Rs. 1,329.00Sale -

Tax Planning - Practical Aspects As amended by the Finance Act, 2025 By CA. Chunauti H. Dholakia - 2nd Edition 2025 - Bharat Law House

Regular price Rs. 909.00Regular priceUnit price perRs. 1,295.00Sale price Rs. 909.00Sale -

Know When to Say NO to Cash Transactions - As amended by the finance Act, 2025 - 3rd Edition 2025 by CA. (Dr. ) Girish Ahuja | Bharat Law House

Regular price Rs. 499.00Regular priceUnit price perRs. 650.00Sale price Rs. 499.00Sale -

Handbook on Tax Deduction at Source Including Tax Collection at Source By CA. P.T. Joy - 9th Edition 2025 - Bharat Law House

Regular price Rs. 559.00Regular priceUnit price perRs. 795.00Sale price Rs. 559.00Sale -

Universal’s Guide to Judicial Service Examination - 20th edition 2025 | LexisNexis

Regular price Rs. 1,449.00Regular priceUnit price perRs. 1,695.00Sale price Rs. 1,449.00Sale -

Practical Guide on TDS and TCS As amended by The Finance (No.2) Act, 2025 By G. Sekar - 24th Edition 2025 - Commercial Law Publishers

Regular price Rs. 969.00Regular priceUnit price perRs. 1,499.00Sale price Rs. 969.00Sale -

Handbook To DIRECT TAXES by Bomi F. Daruwala-34rd Edition 2025- Bharat Law House

Regular price Rs. 1,679.00Regular priceUnit price perRs. 2,395.00Sale price Rs. 1,679.00Sale