-

Income Tax Act 2025 - 71st Edition 2025 | Taxmann

Regular price Rs. 1,799.00Regular priceUnit price perRs. 2,395.00Sale price Rs. 1,799.00Sale -

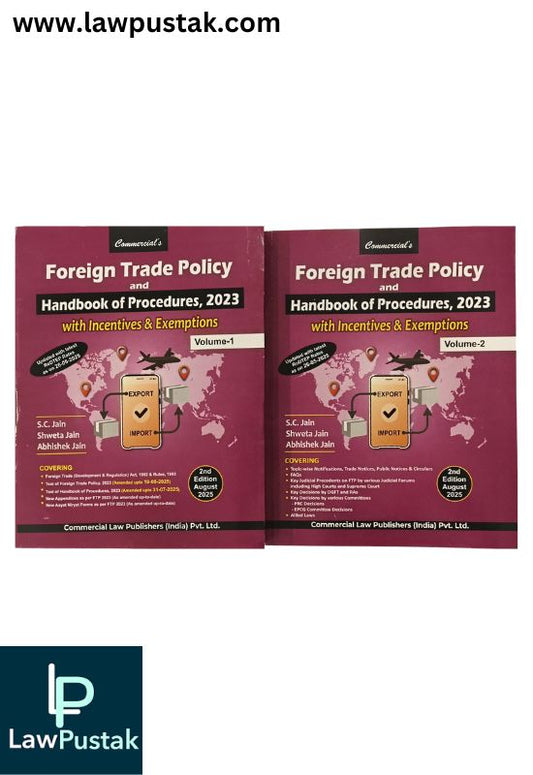

Foreign Trade Policy and Handbook of Procedure, 2023 with Incentives & Exemptions by S.C. Jain, Shweta Jain & Abhishek Jain - 2nd Edition August 2025 (Set of 2 Volumes) | Commercial Law Publishers (India) Pvt. Ltd.

Regular price Rs. 2,139.00Regular priceUnit price perRs. 3,295.00Sale price Rs. 2,139.00Sale -

Master Guide to Income Tax Act 2025 - 36th Edition 2025 | Taxmann

Regular price Rs. 2,099.00Regular priceUnit price perRs. 2,795.00Sale price Rs. 2,099.00Sale -

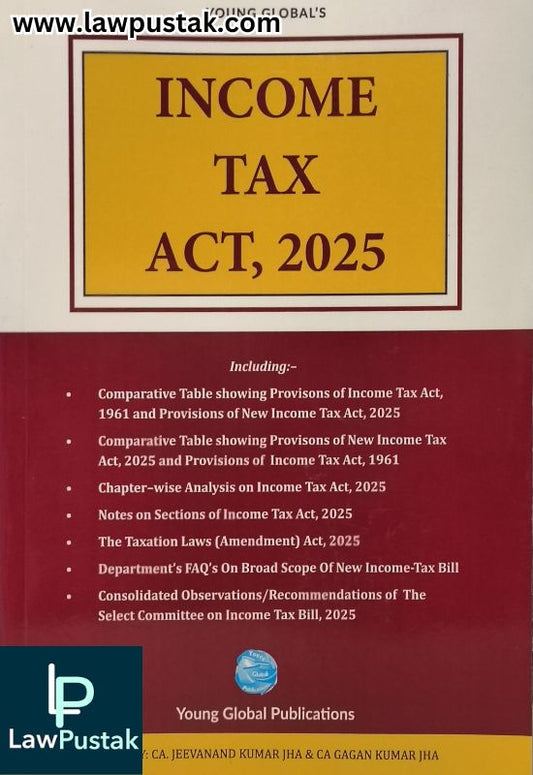

Income Tax Act, 2025 | Young Global Publications

Regular price Rs. 1,499.00Regular priceUnit price perRs. 2,495.00Sale price Rs. 1,499.00Sale -

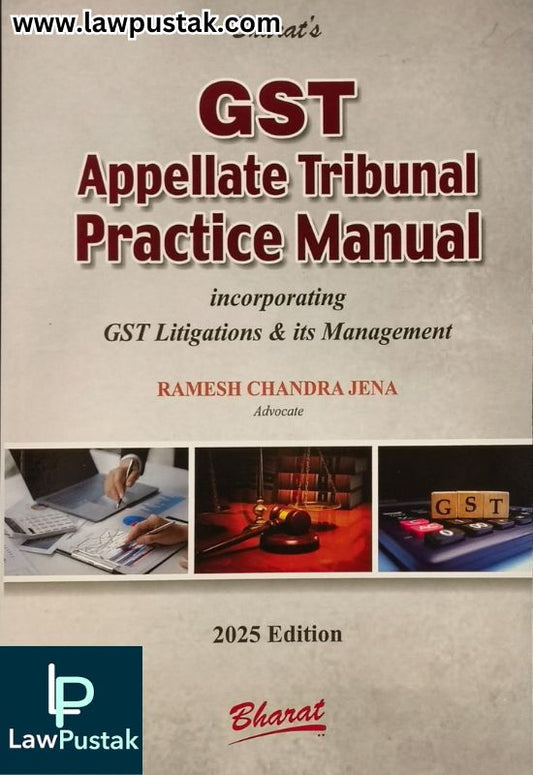

GST Appellate Tribunal Practice Manual - Incorporating GST Litigations & its Management by Ramesh Chandra Jena - Edition 2025 | Bharat Law House Pvt. Ltd.

Regular price Rs. 979.00Regular priceUnit price perRs. 1,395.00Sale price Rs. 979.00Sale -

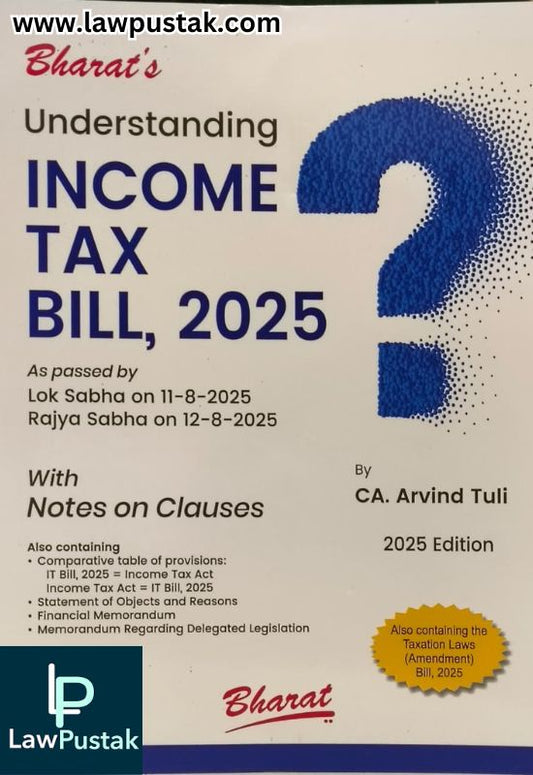

Understanding Income Tax Bill, 2025 by CA. Arvind Tuli | Bharat Law House Pvt. Ltd.

Regular price Rs. 849.00Regular priceUnit price perRs. 1,295.00Sale price Rs. 849.00Sale -

Income Tax Act 2025 - Including Judicial Pronouncement, Comparative Table Showing Provisions of Income Tax Act, 1961 and Provisions of New Income Tax Act, 2025 by Dr. Girish Ahuja and Dr. Ravi Gupta | Commercial Law Publishers (India) Pvt. Ltd.

Regular price Rs. 1,599.00Regular priceUnit price perRs. 2,495.00Sale price Rs. 1,599.00Sale -

The Income Tax Act, 1961 - Bare act -Edition 2025 | Commercial Law Publishers (India) Pvt. Ltd.

Regular price Rs. 769.00Regular priceUnit price perRs. 1,195.00Sale price Rs. 769.00Sale -

How to Handle GST Notice, Scrutiny Assessment Adjudication & Appeals by Rakesh Garg and Sandeep Garg - 3rd Edition 2025 | Commercial Law Publishers (India) Pvt. Ltd.

Regular price Rs. 769.00Regular priceUnit price perRs. 1,495.00Sale price Rs. 769.00Sale -

Formation, Management & Taxation of Charitable and Religious Trusts & Institutions under Direct Tax Laws by Ram Dutt Sharma - 10th Edition 2025 | Commercial Law Publishers (India) Pvt. Ltd.

Regular price Rs. 1,949.00Regular priceUnit price perRs. 2,995.00Sale price Rs. 1,949.00Sale -

Reverse Charge Mechanism Under GST by CA. Satbir Singh - 4th Edition 2025 | Bharat Law House Pvt. Ltd.

Regular price Rs. 799.00Regular priceUnit price perRs. 1,195.00Sale price Rs. 799.00Sale -

Hindu Undivided Family - Formation, Management & Taxation by CA. Pawan K. Jain - 16th Edition 2025 | Bharat Law House Pvt. Ltd.

Regular price Rs. 1,039.00Regular priceUnit price perRs. 1,595.00Sale price Rs. 1,039.00Sale -

Manual for Business and Establishments in Delhi | A Nabhi Pubication

Regular price Rs. 479.00Regular priceUnit price perRs. 690.00Sale price Rs. 479.00Sale -

Combined Examination Guide for Section Officer/ Steno with Multiple Choice Questions (MCQs) - Paper 2 | A Nabhi Publication

Regular price Rs. 579.00Regular priceUnit price perRs. 650.00Sale price Rs. 579.00Sale -

Compendium of Central Civil Services Conduct Rules - Alongwith Government of India Decisions | A Nabhi Pulblication

Regular price Rs. 399.00Regular priceUnit price perRs. 490.00Sale price Rs. 399.00Sale -

Manual of New Unfied Building Bye-Laws for Delhi, 2016 | A Nabhi Publication

Regular price Rs. 1,219.00Regular priceUnit price perRs. 1,790.00Sale price Rs. 1,219.00Sale