-

Methods of Investigations of Books of Accounts and Other Documents By Ram Dutt Sharma-Edition 2024-Commercial's

Regular price Rs. 906.00Regular priceUnit price perRs. 1,295.00Sale price Rs. 906.00Sale -

Understanding the Special provisions of Presumptive Taxation Scheme By Ram Dutt Sharma-Edition 2024-Commercial's

Regular price Rs. 486.00Regular priceUnit price perRs. 695.00Sale price Rs. 486.00Sale -

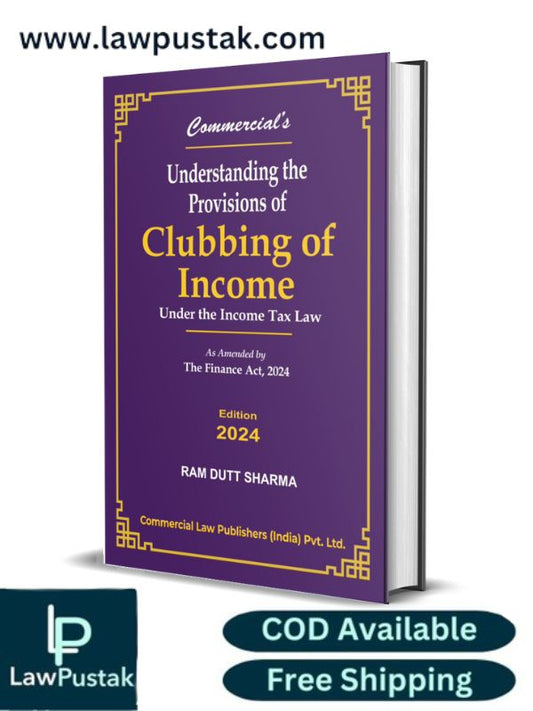

Understanding the Provisions of Clubbing of Income By Ram Dutt Sharma-Edition 2024-Commercial's

Regular price Rs. 486.00Regular priceUnit price perRs. 695.00Sale price Rs. 486.00Sale -

Income Tax Refunds (Law & Procedure) Under the Income Tax Law As amended by the Finance Act, 2024 By Ram Dutt Sharma - Edition 2024 - Commercial Law Publishers

Regular price Rs. 599.00Regular priceUnit price perRs. 695.00Sale price Rs. 599.00Sale -

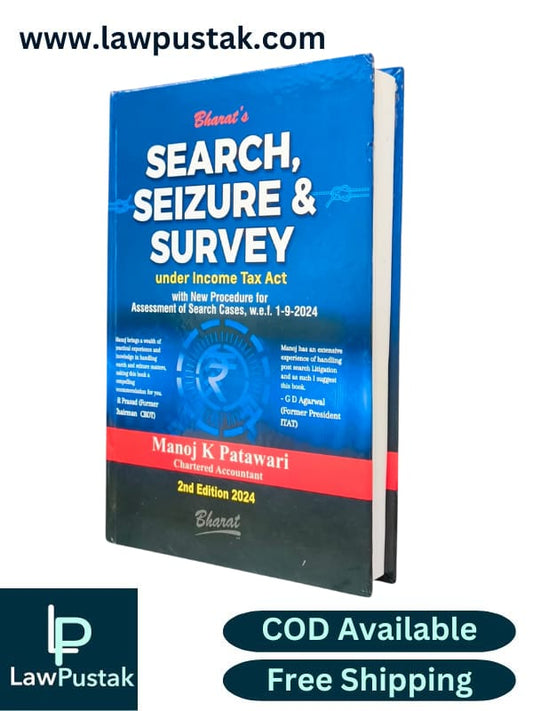

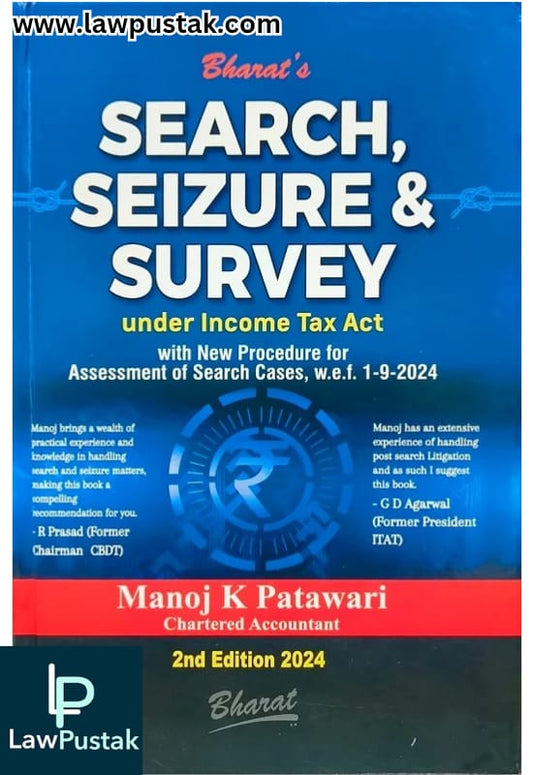

SEARCH, SEIZURE & SURVEY by CA. Manoj K Patawari - 2nd Edition 2024

Regular price Rs. 799.00Regular priceUnit price perRs. 1,095.00Sale price Rs. 799.00Sale -

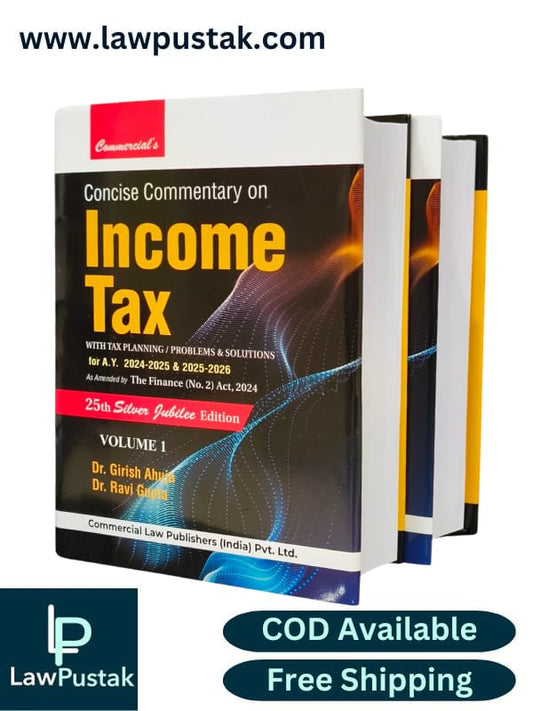

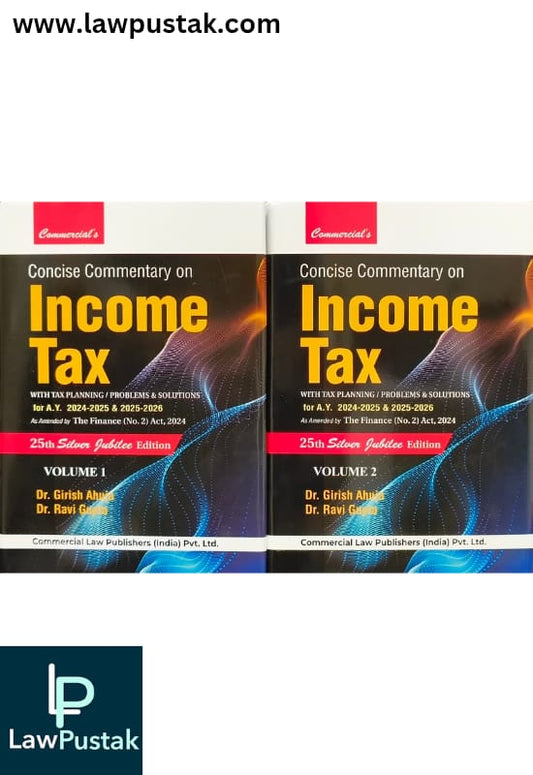

Concise Commentary on Income Tax with Tax Planning / Problems & Solutions | In 2 Volumes | Dr. Girish Ahuja & Dr. Ravi Gupta | 25th Edition 2024

Regular price Rs. 3,799.00Regular priceUnit price perRs. 5,995.00Sale price Rs. 3,799.00Sale -

Authority for Advance Ruling under Gst Laws by R. K. Bhalla-July,2023-Young Global's

Regular price Rs. 1,197.00Regular priceUnit price perRs. 1,995.00Sale price Rs. 1,197.00Sale -

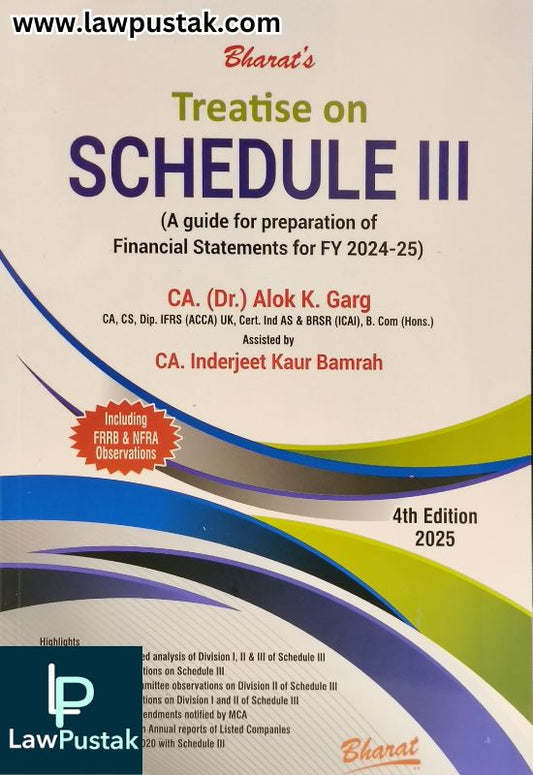

Treatise on Schedule III (A guide for preparation of Financial Statements for FY 2024-25)- 4th Edition 2025-Bharat Law House Pvt. Ltd.

Regular price Rs. 769.00Regular priceUnit price perRs. 1,095.00Sale price Rs. 769.00Sale -

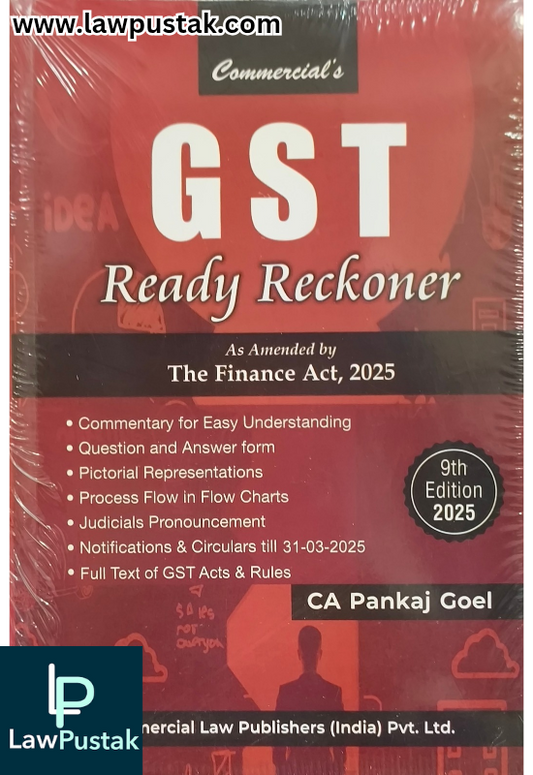

GST Ready Reckoner as Amended by The Finance Act, 2025 By CA Pankaj Goel - 9th Edition 2025 - Commercial Law Publisher

Regular price Rs. 2,099.00Regular priceUnit price perRs. 2,995.00Sale price Rs. 2,099.00Sale -

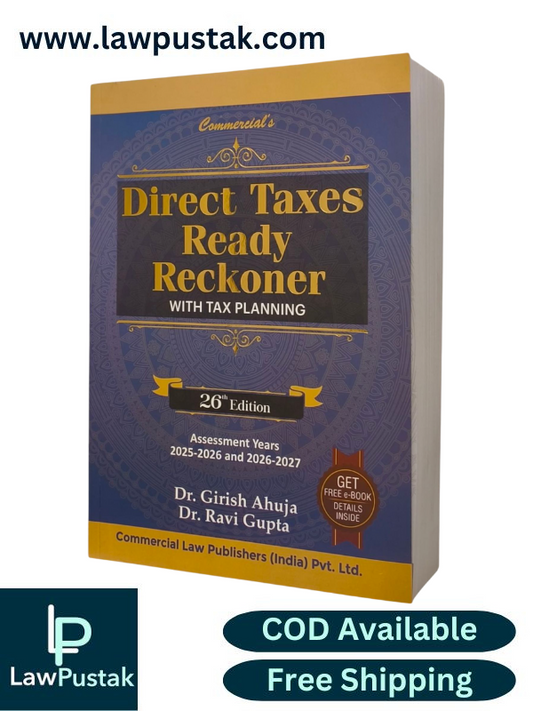

Direct Taxes Ready Reckoner with Tax Planning By Dr. Girish Ahuja & Dr. Ravi Gupta - 26th Ediition 2025 - Commercial Law Publishers

Regular price Rs. 1,429.00Regular priceUnit price perRs. 2,195.00Sale price Rs. 1,429.00Sale -

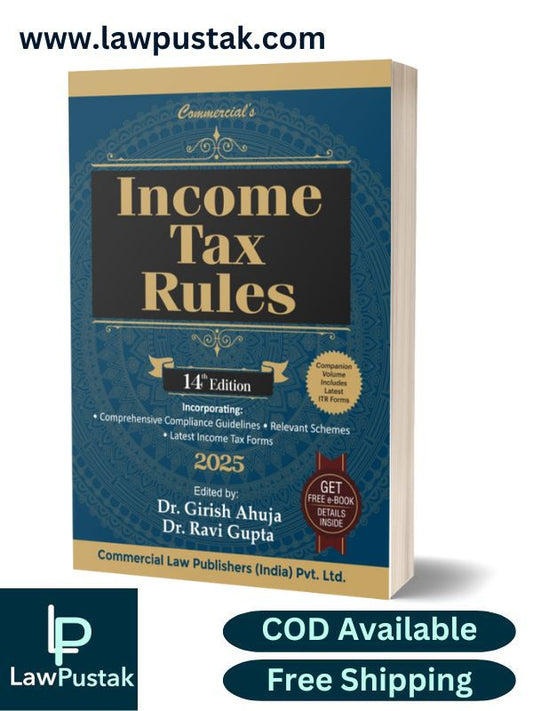

Income Tax Rules By Dr. Girish Ahuja & Dr. Ravi Gupta - 14th Edition 2025 - Commercial Law Publishers

Regular price Rs. 1,749.00Regular priceUnit price perRs. 2,695.00Sale price Rs. 1,749.00Sale -

Income Tax Act As Amended by The Finance Act, 2025 By Dr. Girish Ahuja & Dr. Ravi Gupta - 14th Edition 2025 - Commercial Law Publishers

Regular price Rs. 1,749.00Regular priceUnit price perRs. 2,695.00Sale price Rs. 1,749.00Sale -

Taxation of Capital Gains as amended by the Finance Act, 2025 By Dr. Girish Ahuja & Dr. Ravi Gupta - Commercial Law Publishers

Regular price Rs. 1,599.00Regular priceUnit price perRs. 2,295.00Sale price Rs. 1,599.00Sale -

Loophole Games—A Treatise On Tax Avoidance Strategies by Smarak Swain-Commercial

Regular price Rs. 1,046.00Regular priceUnit price perRs. 1,495.00Sale price Rs. 1,046.00Sale -

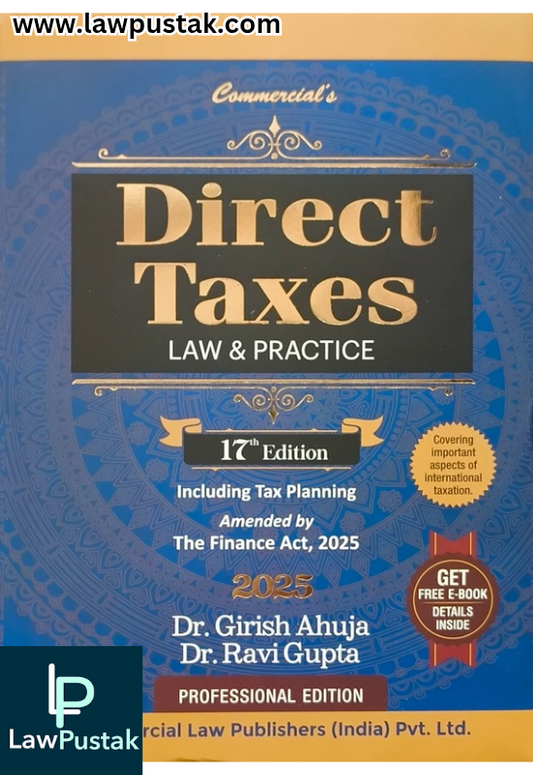

Direct Taxes | Law & Practice | (DTL) | As Amended by The Finance Act, 2025 | 17th Edition 2025 | Dr. Girish Ahuja & Dr. Ravi Gupta

Regular price Rs. 2,579.00Regular priceUnit price perRs. 4,295.00Sale price Rs. 2,579.00Sale -

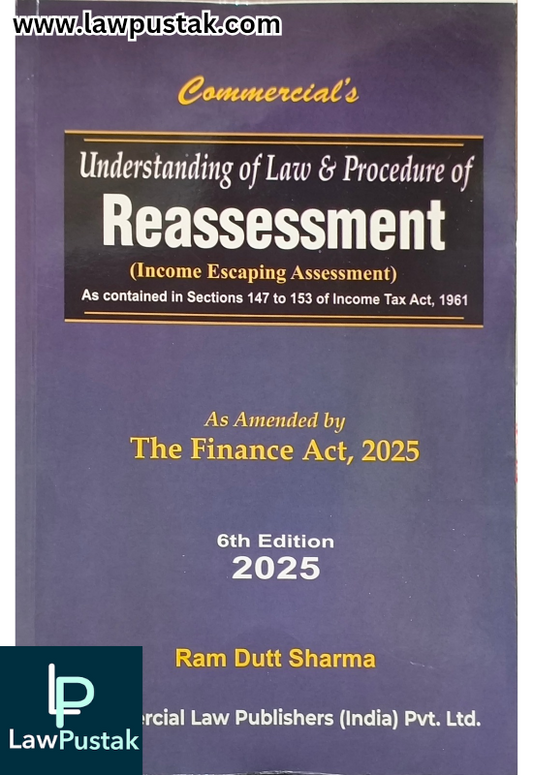

Understanding of Law & Procedure of Reassessment (Income Escaping Assessment) As Contained in Sections 147 to 153 of Income Tax Act, 1961 As Amended By The Finance Act, 2025 By Ram Dutt Sharma - Commercial Law Publishers

Regular price Rs. 699.00Regular priceUnit price perRs. 995.00Sale price Rs. 699.00Sale