-

Handbook on Tax Deduction at Source Including Tax Collection at Source By CA. P.T. Joy - 9th Edition 2025 - Bharat Law House

Regular price Rs. 559.00Regular priceUnit price perRs. 795.00Sale price Rs. 559.00Sale -

Know When to Say NO to Cash Transactions - As amended by the finance Act, 2025 - 3rd Edition 2025 by CA. (Dr. ) Girish Ahuja | Bharat Law House

Regular price Rs. 499.00Regular priceUnit price perRs. 650.00Sale price Rs. 499.00Sale -

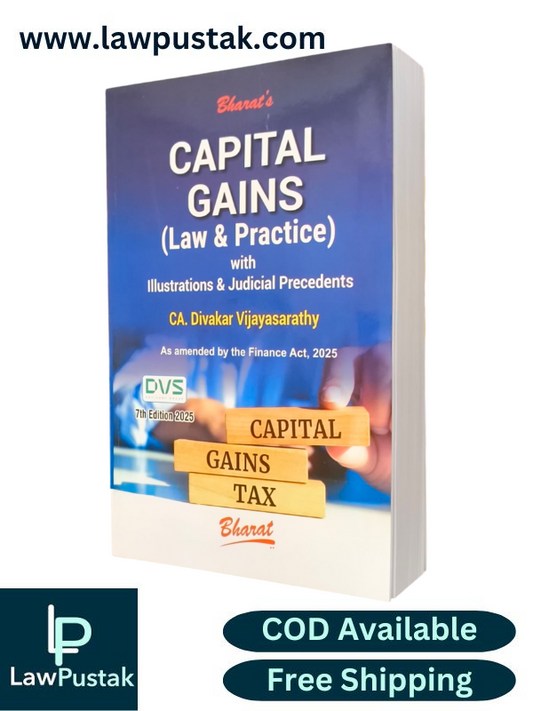

CAPITAL GAINS (Law & Practice) with Illustrations & Judicial Precedents by CA. Divakar Vijayasarathy - 7th Edition 2025 - Bharat Law House

Regular price Rs. 1,649.00Regular priceUnit price perRs. 2,350.00Sale price Rs. 1,649.00Sale -

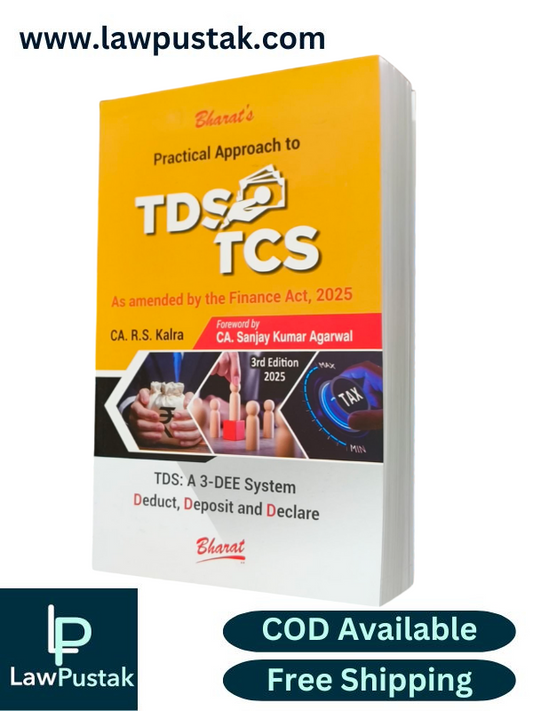

Practical Approach to TDS & TCS by CA. R.S. Kalra-3rd Edition 2025-Bharat law House

Regular price Rs. 879.00Regular priceUnit price perRs. 1,250.00Sale price Rs. 879.00Sale -

Bharat's INCOME COMPUTATION & DISCLOSURE STANDARDS by CA. Kamal Garg

Regular price Rs. 920.00Regular priceUnit price perRs. 1,395.00Sale price Rs. 920.00Sale -

TAX AUDIT and E-FILING (for AY 2025-2026) by CA. Kamal Garg-13th Edition 2025-Bharat Law House

Regular price Rs. 1,749.00Regular priceUnit price perRs. 2,495.00Sale price Rs. 1,749.00Sale -

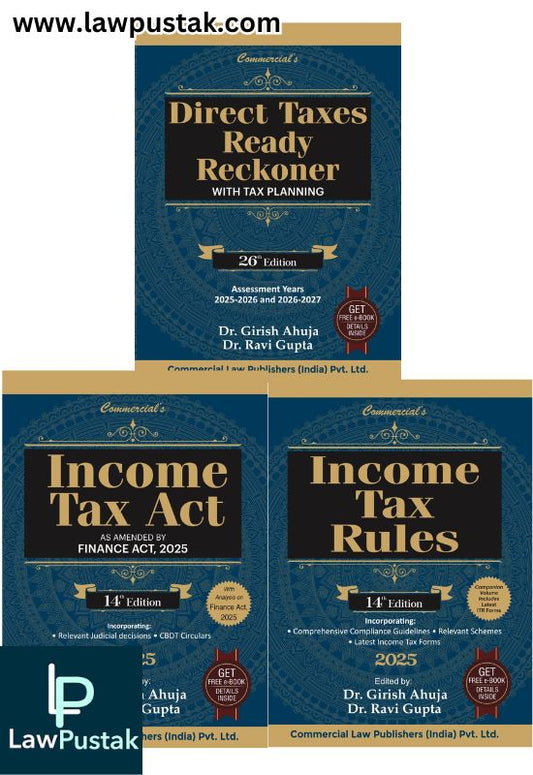

Combo Income Tax II (Direct Tax Ready Reckoner + Income Tax Act + Income Tax Rules) By Dr. Girish Ahuja & Dr. Ravi Gupta - 2025 Edition (set of 3 Book) - Commercial Law Publishers

Regular price Rs. 4,549.00Regular priceUnit price perRs. 7,585.00Sale price Rs. 4,549.00Sale -

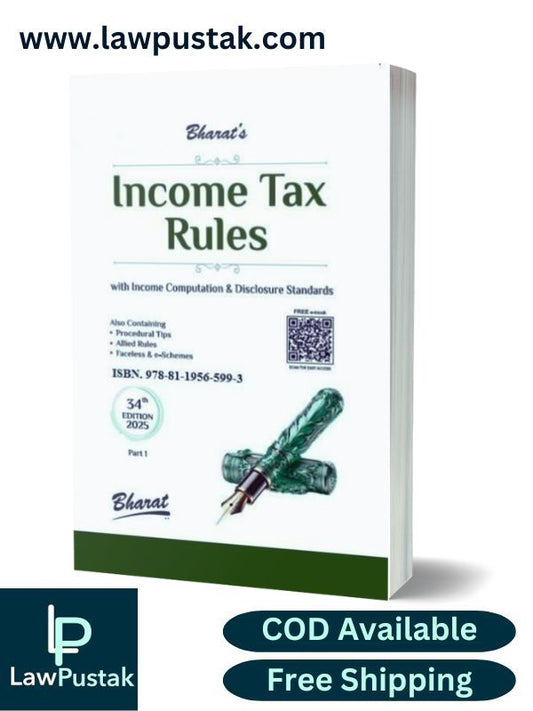

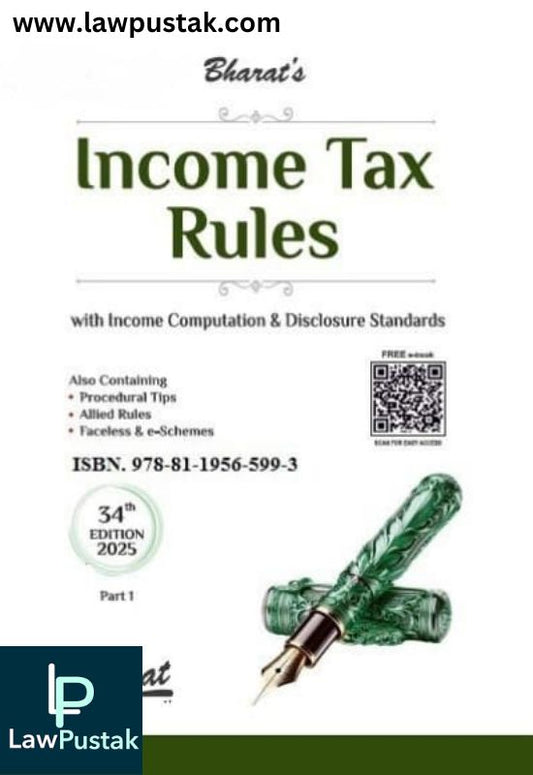

Income Tax Rules - 34rd Edition 2025 - Bharat Law House

Regular price Rs. 1,889.00Regular priceUnit price perRs. 2,695.00Sale price Rs. 1,889.00Sale -

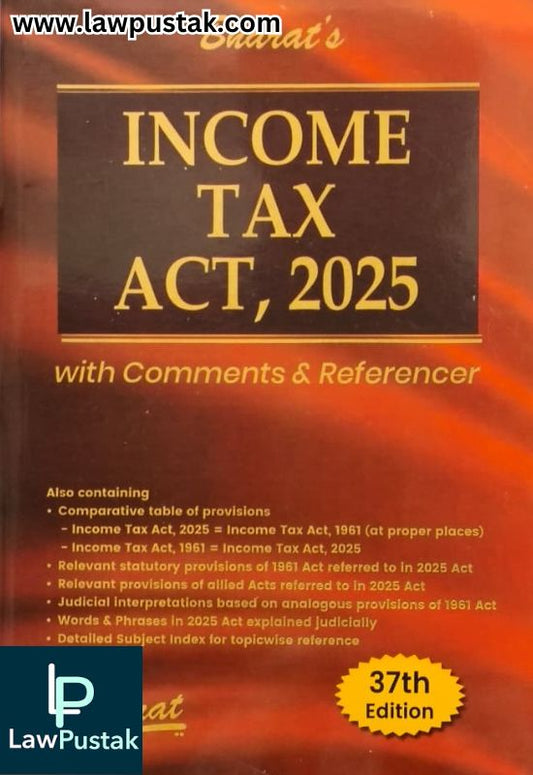

INCOME TAX ACT - 37th Edition 2025 - Bharat Law House

Regular price Rs. 1,649.00Regular priceUnit price perRs. 2,395.00Sale price Rs. 1,649.00Sale